Why Smart Tax Deductions Matter for Business Owners

For businesses looking to grow sustainably, understanding tax deductions isn’t just a bonus—it’s a necessity. Deductions help minimize tax liability, leaving you with more working capital. Whether you’re a startup or scaling fast, knowing which expenses qualify can create a major impact on your financial strategy.

Understanding Business Tax Deductions: A Quick Overview

A tax deduction reduces your taxable income and is subtracted from your gross income. Businesses can claim deductions for expenses deemed “ordinary and necessary” to run their operations—everything from rent and wages to software subscriptions.

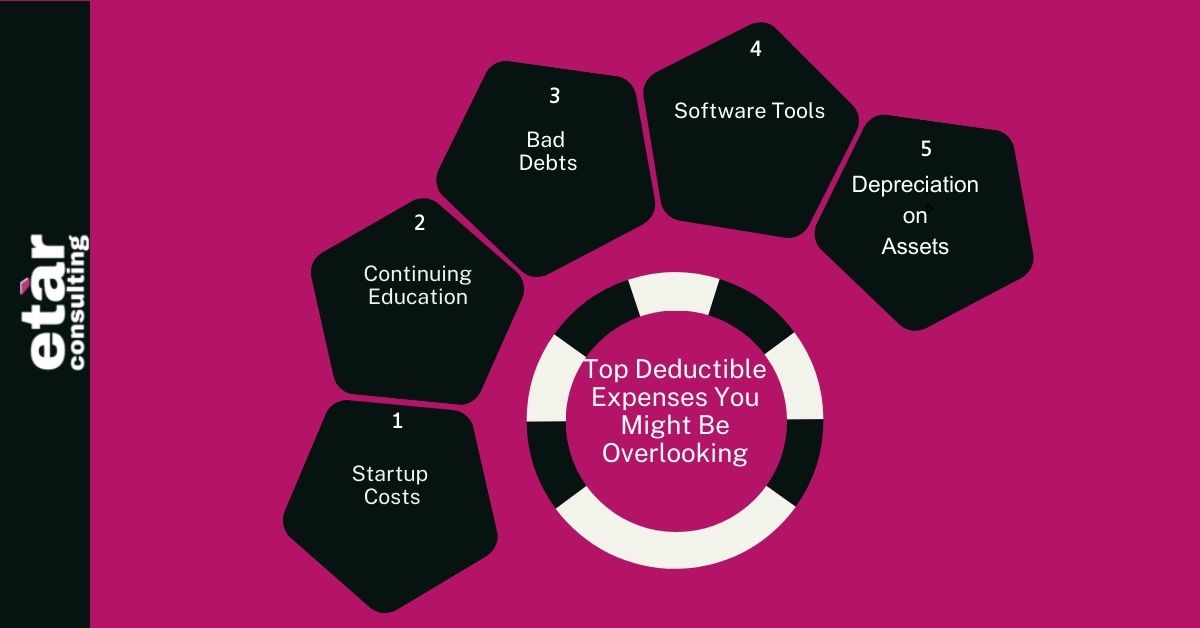

Top Deductible Expenses You Might Be Overlooking

Many businesses overlook important deductible expenses such as:

- Startup Costs

- Continuing Education

- Bad Debts

- Software Tools

- Depreciation on Assets

Understanding these categories allows you to keep more of your money in-house.

Strategic Timing: When to Make Purchases and Claim Deductions

Smart timing can multiply your savings:

- Make major purchases before the end of the fiscal year.

- Defer income into the next year if you expect to be in a lower tax bracket.

- Accelerate payments for recurring services to lock in deductions.

These tax saving strategies can help improve year-end results without legal complexity.

Home Office Deductions: Rules Every Remote Business Should Know

If your home includes a workspace used exclusively for business, you’re eligible for a home office deduction. You can deduct a portion of your mortgage, rent, utilities, and even maintenance costs. The IRS simplified method ($5 per square foot up to 300 sq ft) also offers a streamlined alternative.

Travel & Entertainment: What’s Actually Deductible in 2025?

Travel expenses remain a commonly claimed business deduction:

- Business flights, accommodation, and meals while traveling are usually deductible.

- Business-related meals with clients are 50% deductible.

- Entertainment expenses are largely non-deductible unless they directly relate to business discussions.

Just remember: recordkeeping is key.

How to Maximize Vehicle and Mileage Deductions

When a personal vehicle is used for business:

- Track your mileage with a digital log.

- Use the IRS standard mileage rate (70 cents/mile in 2025).

- Alternatively, calculate actual expenses and deduct the business-use percentage.

Using Technology and Software to Track Deductible Expenses

Apps like QuickBooks, FreshBooks, and Wave can automate:

- Expense categorization

- Receipt tracking

- Year-end reports

This allows for real-time visibility and reduces missed deductions.

Avoiding Common Tax Deduction Mistakes

Some missteps could cost your business more than you realize:

- Failing to separate personal and business expenses

- Not keeping receipts or records

- Claiming non-qualifying entertainment expenses

- Misclassifying independent contractors

Always check IRS rules—or better yet, consult experts like etarconsulting for peace of mind.

How etera consulting Can Help Businesses Save More

Navigating deductions and credits can be complex—especially for growing businesses. That’s where etarconsulting comes in.

Their team offers customized guidance for businesses seeking to optimize their financial operations. From bookkeeping to tax planning, they help you uncover every opportunity to reduce your business tax burden. Visit their Tax Services page for more details.

Powerful Tax Strategies to Reduce Taxable Income

Implementing long-term tax strategies to reduce taxable income can mean substantial savings over time. Consider:

- Investing in energy-efficient equipment

- Setting up a retirement plan for your employees

- Taking advantage of R&D tax credits

For tax deductions for high income earners, strategic planning is key. Many deductions and credits begin phasing out at higher income levels, so proactive measures like charitable contributions, depreciation, or accelerated deductions can offset that impact.

Tax Planning Made Easy: Expert Tips for Every Tax Category

| Tax | Tips |

| Corporate income tax Tips | – Keep detailed records of all business income and expenses.- Take advantage of available tax credits and deductions.- File estimated taxes quarterly to avoid penalties.- Work with a tax advisor for long-term planning. |

| Sales tax Tips | – Register for sales tax in every state where you have nexus.- Keep valid exemption certificates for non-taxable sales.- Automate sales tax calculations with software.- File returns on time to avoid fines.- Stay updated on changing tax laws in different states. |

| Individual income tax Tips | – Choose the right filing status for maximum savings.- Contribute to retirement accounts to reduce taxable income.- Keep receipts for itemized deductions.- Claim all eligible tax credits.- File electronically for faster refunds. |

| Employee withholding tax Tips | – Ensure employees complete and update Form W-4 correctly.- Use payroll software to calculate accurate withholdings.- Remit taxes to the IRS and state agencies on time.- Stay compliant with federal and state wage laws.- Review withholding annually, especially after major life events. |

| Tax deduction strategies Tips | – Track business and personal deductions separately.- Maximize deductions with charitable giving and education credits.- Use a home office deduction if eligible.- Deduct health care premiums if self-employed.- Consider bunching deductions into one tax year for greater savings. |

Conclusion

Running a business is no small feat—and neither is navigating its taxes. But armed with the right knowledge and support, you can take full advantage of tax rules to reduce liabilities and invest in your future. Whether it’s maximizing your deductions or deploying advanced tax saving strategies, planning ahead gives your business the edge it needs to grow smart.

Partnering with professionals like etarconsulting ensures you’re not leaving money on the table.

FAQs

Q1: Can I deduct meals with clients?

Yes, but only 50% of the cost is deductible, and it must be business-related.

Q2: What if I use my car for both business and personal use?

Only the business-use portion of expenses can be deducted. Keep detailed mileage logs.

Q3: Are travel costs for conferences deductible?

Yes, including flights, lodging, and meals—if the event is directly related to your business.

Q4: Is software considered a deductible expense?

Absolutely. Software used for business purposes, whether monthly subscriptions or one-time purchases, can be deducted.

Q5: Can high earners still benefit from deductions?

Yes, but some deductions phase out at higher income levels. Specialized tax deductions for high income earners and strategies from experts like etarconsulting can help mitigate that.