When it comes to maintaining transparency, accuracy, and trust in your company’s financial reporting, a statutory audit plays a crucial role. Whether you are a startup, an established business, or a nonprofit organization, understanding the importance of a statutory audit can help you safeguard your financial integrity and compliance. In this blog, we explore the top 5 benefits of a statutory audit, why it matters, and how trusted providers like EtarConsulting can support your journey.

1. Unlocking Transparency: What Is a Statutory Audit?

Before diving into the benefits, it’s essential to clarify what a statutory audit is. Simply put, it is a legally required audit of a company’s financial statements conducted by an independent external auditor. This audit ensures that the financial records fairly represent the company’s financial position and comply with applicable laws and accounting standards.

Companies preparing for their annual statutory audit should work closely with experienced professionals to ensure accuracy and compliance. For businesses seeking professional external audit services, EtarConsulting offers comprehensive solutions to guide you through every step. Their team specializes in providing accurate, timely, and reliable audits that adhere strictly to regulatory requirements, helping you stay compliant and confident.

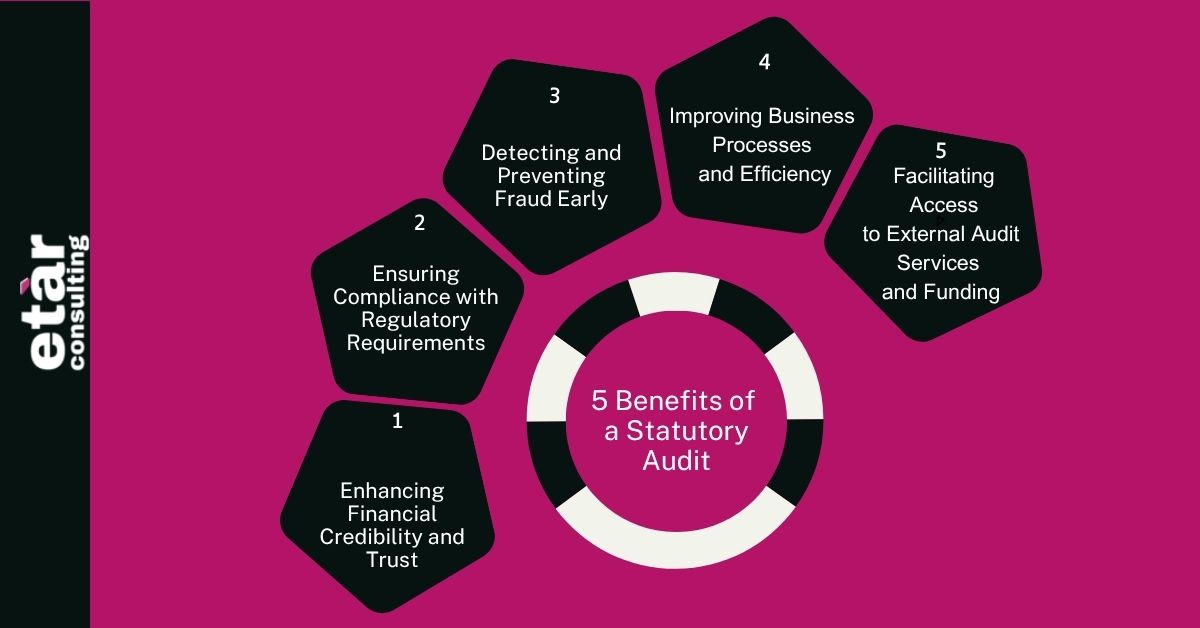

Benefits of a Statutory Audit

2. Benefit #1: Enhancing Financial Credibility and Trust

One of the primary benefits of a statutory audit is the enhanced credibility it brings to your financial statements. When your accounts are audited by a qualified external auditor, stakeholders—including investors, creditors, and regulatory bodies—gain confidence in the accuracy of your financial data.

This credibility is vital for companies looking to attract investment or expand their business. By engaging a reputable audit firm like EtarConsulting, you demonstrate a commitment to transparency and accountability, reinforcing trust in your operations.

3. Benefit #2: Ensuring Compliance with Regulatory Requirements

Statutory audits are mandated by law in many jurisdictions for certain types of companies. Complying with this legal obligation through a thorough audit helps prevent penalties and legal challenges. More importantly, it ensures your business operates within the regulatory framework.

This is where statutory audit compliance becomes crucial. Auditors evaluate whether your organization meets all statutory and regulatory standards. Compliance is not just about ticking boxes; it’s about embedding compliance controls within your processes. A statutory audit identifies areas where your company can strengthen these controls, reducing risks and promoting sustainable growth. For more on compliance and audit services, visit EtarConsulting’s services page.

4. Benefit #3: Detecting and Preventing Fraud Early

Fraud detection is a critical aspect of statutory audits. External auditors review your company’s financial transactions and records to identify irregularities, misstatements, or suspicious activities.

Early detection of potential fraud protects your company from financial loss and reputational damage. A statutory audit provides an extra layer of scrutiny that internal teams might miss, ensuring your business stays secure and trustworthy.

5. Benefit #4: Improving Business Processes and Efficiency

Beyond compliance and fraud prevention, statutory audits provide valuable insights into your company’s financial and operational processes. Auditors often recommend improvements to internal controls and procedures based on their findings.

These recommendations can lead to more efficient business processes, better financial management, and reduced risks. Leveraging both internal and statutory audit results can give your company a comprehensive view of its strengths and weaknesses. With expert guidance from EtarConsulting, you can transform audit outcomes into actionable strategies that enhance your company’s performance.

6. Benefit #5: Facilitating Access to External Audit Services and Funding

A clean statutory audit report is often a prerequisite for securing financing from banks, investors, and other funding sources. Lenders and investors want assurance that your financial statements are accurate and reliable.

By choosing professional external audit services through a trusted firm like EtarConsulting, you position your company as a transparent and dependable business partner. This credibility can open doors to new growth opportunities and capital.

Preparing for a Successful Audit: Avoiding Common Pitfalls

Successful audit outcomes begin well before auditors arrive. Proper external audit preparation involves organizing documents, reviewing financial records, and understanding regulatory requirements.

Many businesses fall victim to common audit mistakes to avoid, such as incomplete records or lack of communication. With proactive planning and support from EtarConsulting, you can ensure a smooth audit process that minimizes surprises and maximizes accuracy.

Effective External Audit Management: Keeping Things on Track

Managing an audit process can be complex, especially for growing companies. Effective external audit management requires clear timelines, defined roles, and continuous communication between your team and auditors.

EtarConsulting excels in providing support that streamlines audit management, helping businesses meet deadlines and maintain clarity throughout the process.

Why Choose EtarConsulting for Your Statutory Audit Needs?

Navigating the complexities of statutory audits requires expertise and experience. EtarConsulting is dedicated to providing personalized audit solutions tailored to your business size and industry. Their professional team combines deep technical knowledge with practical insights, ensuring your audit is not just a regulatory requirement but a valuable business tool.

They offer a wide range of external audit services, helping companies comply with statutory obligations, improve internal controls, and gain stakeholder trust. To learn more or to discuss your audit needs, don’t hesitate to contact us directly.

Getting Started: How to Contact Us for Professional Audit Support

Starting your statutory audit process with EtarConsulting is straightforward. Their team is ready to assist you with tailored solutions that fit your unique requirements. Visit the Contact Us page to schedule a consultation, request a quote, or ask any questions related to your audit or compliance needs.

Discover Key Audit Tips to Strengthen Your Financial Controls

| External Audit | Tips |

| – Focus on adherence to internal policies, laws, and regulations. – Emphasize risk mitigation and operational integrity. – Useful in regulated industries like healthcare, finance, or manufacturing. | |

| – Highlight the verification of financial records and statements. – Can be internal or external. – Stress accuracy, completeness, and fairness of financial data. | |

| – Mention that it’s a legally required audit by government or regulatory bodies. – Ensure compliance with local legal frameworks (e.g., Companies Act, tax laws). | |

| – Explain it as a subset of financial audit, focusing specifically on statements like balance sheets, P&L, etc. – Clarify it aims to provide an independent opinion on financial statements. | |

| – Define ISAs as global frameworks set by the IAASB. – Reference key ISAs like ISA 315 (risk assessment) or ISA 700 (audit opinion). – Promote consistency and comparability in global audits. |

Conclusion

A statutory audit is much more than a legal formality—it’s a strategic tool that enhances financial transparency, boosts credibility, ensures compliance, prevents fraud, and improves business efficiency. With the right audit partner like EtarConsulting, you can leverage these benefits to build a stronger, more trustworthy business foundation.

Investing in professional statutory audit services will not only keep you compliant but also help unlock growth opportunities and stakeholder confidence. If you want to learn more or get expert support for your statutory audit, don’t hesitate to reach out to EtarConsulting today.

FAQs

1. What is the main purpose of a statutory audit?

A statutory audit is conducted to verify the accuracy and fairness of a company’s financial statements and ensure compliance with legal regulations.

2. How often is an annual statutory audit required?

It is typically an annual requirement for certain business entities, depending on jurisdiction and company size.

3. What are some common audit mistakes to avoid?

Incomplete documentation, lack of communication, and unpreparedness are some common pitfalls that can delay or complicate the audit process.

4. How does internal and statutory audit differ?

Internal audits are conducted by a company’s own team for internal controls, while statutory audits are independent and legally mandated external reviews.

5. How can I prepare effectively for an external audit?

Effective external audit preparation includes organizing your financial documents, reviewing compliance controls, and working closely with your auditor. For expert guidance, contact us.