In the dynamic business landscape of 2025, financial audIn today’s fast-paced business environment, maintaining regulatory compliance is more than just a legal obligation — it’s a strategic advantage. A compliance audit helps organizations verify whether they are following applicable laws, standards, and internal policies. Whether you’re in finance, manufacturing, or services, understanding the audit process can protect your company from costly violations and reputational harm.

If you’re looking to simplify compliance and strengthen governance, this guide will walk you through each phase of the audit journey.

What Is a Compliance Audit and Why It Matters

A compliance audit is an independent review conducted to determine whether an organization adheres to external regulations and internal controls. These audits assess everything from tax codes and labor laws to environmental rules and industry-specific guidelines.

Failing a compliance audit can lead to fines, sanctions, or loss of certification. More importantly, it can erode client trust. That’s why organizations partner with experienced firms like EtarConsulting, who understand the intricate details of regulatory frameworks across industries.

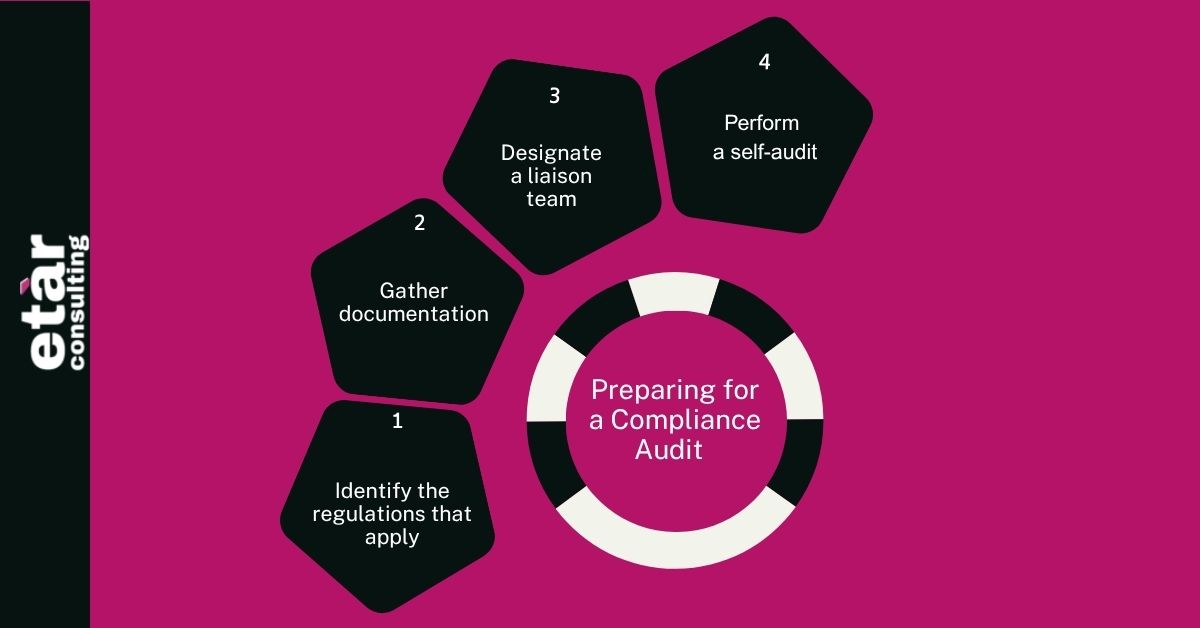

Preparing for a Compliance Audit

Preparation is key. Before the audit begins, you must define its scope — what departments, laws, or processes are under review?

Here are essential steps to prepare:

- Identify the regulations that apply to your business (e.g., GDPR, ISO standards, tax regulations).

- Gather documentation such as policies, procedures, training records, and historical compliance reports.

- Designate a liaison team responsible for communication with the auditor.

- Perform a self-audit to catch issues beforehand.

Companies often turn to consulting firms like Etar Consulting to ensure readiness. With a deep understanding of regulatory environments and local industry practices, Etar provides tailored insights that reduce audit risk.

Step-by-Step Breakdown of the Compliance Audit Process

Understanding each step of the compliance audit can remove much of the stress. Here’s a simplified walkthrough:

1. Planning

The auditor defines the scope, sets timelines, and identifies areas of risk.

2. Notification

You receive an audit notification outlining objectives, required documents, and audit dates.

3. Fieldwork

Auditors conduct interviews, review records, and inspect systems or processes.

4. Evaluation

Findings are analyzed against applicable laws and policies.

5. Reporting

The auditor issues a formal report listing areas of compliance and non-compliance.

6. Corrective Action Plan

You’re expected to address deficiencies within a given timeframe.

Common Compliance Issues to Watch Out For

Even the most organized businesses make mistakes. Common pitfalls include:

- Outdated policies that don’t reflect current regulations.

- Lack of employee training, leading to accidental non-compliance.

- Improper documentation, especially for financial and safety records.

- Overlooked updates to industry standards.

Being aware of these issues allows you to take proactive measures before an auditor points them out.

Understanding Internal Audit and External Audit Roles

In many organizations, compliance is verified through both internal audit and external audit processes. Internal audits are usually conducted by in-house teams, focusing on operational efficiency and internal controls. External audits are conducted by independent third-party professionals who ensure unbiased compliance reporting.

Both types of audits contribute to stronger accountability and governance structures.

Ensuring Success in a Contract Compliance Audit

A contract compliance audit focuses on whether a company has met the obligations outlined in its contracts — especially in supplier and government relationships. These audits often uncover billing discrepancies, unauthorized charges, or missed deliverables.

With Etar Consulting’s expertise, organizations can proactively review contract performance to avoid disputes or penalties.

Strengthening Your Compliance Controls

Robust compliance controls form the foundation of any successful audit. These may include segregation of duties, access permissions, monitoring protocols, and regular policy reviews. Controls should be embedded into day-to-day operations, not treated as a one-time fix.

Etar Consulting works closely with clients to design and implement effective compliance frameworks that minimize risk and increase audit success rates.

Your Go-To External Audit Checklist

Preparing for an external review is easier when you have an external audit checklist. While every organization’s list may differ, some common items include:

- Updated financial statements

- Compliance training records

- Internal policy manuals

- Risk and incident logs

- Contracts and third-party agreements

Etar’s audit professionals can help you tailor your checklist to align with regulatory requirements and industry best practices.

Applying the Best Practices for Donor Audits

Non-profits and NGOs must follow strict donor requirements. Following the best practices for donor audits includes transparent accounting, evidence of spending, and adherence to grant terms.

Etar Consulting supports non-profits in building donor confidence through clear documentation and compliance strategies aligned with international standards.

Role of External Audits in Enhancing Compliance

While internal audits are important, sometimes a fresh set of eyes is necessary. An External Audit provides an unbiased, third-party evaluation of your compliance posture. It can reveal issues your team may have overlooked and provide assurance to stakeholders and regulators.

To learn how external audits contribute to overall compliance and accountability, explore Etar Consulting’s services. Their team applies global best practices to local business realities, making them a valuable partner in any audit scenario.

Why Choose Etar Consulting for Your Next Compliance Review

Etar Consulting is a trusted financial and business advisory firm based in Amman, Jordan. As a member of the Integra International network, they offer world-class audit and advisory services with a local touch.

Whether you need help preparing for a compliance audit or want to improve your risk management strategies, Etar delivers smart, reliable solutions tailored to your business.

Their services include:

- Internal and external audits

- Risk assessments

- Tax consulting

- Virtual CFO services

- Financial training and advisory

Partnering with Etar means partnering with experts who understand the complexities of compliance — and how to simplify them.

Have Questions or Need Help? Contact Us Today

Need guidance or have specific concerns about an upcoming audit? Don’t leave your compliance to chance. Contact us to speak with a dedicated expert who can help you plan, execute, and follow through on your audit requirements.

Discover Key Audit Tips to Strengthen Your Financial Controls

| External Audit | Tips |

| – Focus on adherence to internal policies, laws, and regulations. – Emphasize risk mitigation and operational integrity. – Useful in regulated industries like healthcare, finance, or manufacturing. | |

| – Highlight the verification of financial records and statements. – Can be internal or external. – Stress accuracy, completeness, and fairness of financial data. | |

| – Mention that it’s a legally required audit by government or regulatory bodies. – Ensure compliance with local legal frameworks (e.g., Companies Act, tax laws). | |

| – Explain it as a subset of financial audit, focusing specifically on statements like balance sheets, P&L, etc. – Clarify it aims to provide an independent opinion on financial statements. | |

| – Define ISAs as global frameworks set by the IAASB. – Reference key ISAs like ISA 315 (risk assessment) or ISA 700 (audit opinion). – Promote consistency and comparability in global audits. |

Conclusion

A compliance audit may seem daunting, but with the right preparation and support, it becomes a powerful tool for improvement. Understanding the process and knowing what to expect gives your business a strong foundation for compliance and growth.

Etar Consulting offers the expertise and personalized service that makes audit readiness easier, more effective, and more aligned with your long-term goals.

FAQs

1. What’s the difference between a compliance audit and a financial audit?

A compliance audit focuses on adherence to laws and policies, while a financial audit evaluates the accuracy of financial records.

2. How often should businesses conduct compliance audits?

Annually is common, but the frequency can vary depending on industry regulations and risk levels.

3. Who typically conducts a compliance audit?

It can be conducted internally or by a third-party like Etar Consulting, depending on the required objectivity.

4. What happens if you fail a compliance audit?

Penalties may include fines, revoked licenses, or reputational damage. However, corrective actions can often resolve issues.

5. Can a compliance audit be conducted remotely?

Yes. Many audits are now partially or fully remote, depending on the nature of the business and available technology.