Why Employee Withholding Tax Matters

Managing employee withholding tax is a critical responsibility for every business owner. Proper handling ensures compliance with tax laws and maintains employee trust. Missteps can lead to penalties and financial strain. This guide offers essential tips to navigate employee withholding tax effectively.

Understanding Employee Withholding: Basics for Business Owners

Employee withholding involves deducting taxes from employees’ wages, including federal income tax, Social Security, and Medicare. Employers must accurately calculate these deductions and remit them to the appropriate tax authorities. Staying informed about current tax rates and regulations is essential to ensure compliance.

Common Withholding Mistakes to Avoid

Avoiding common errors can save your business from costly penalties. Some frequent mistakes include:

- Misclassifying Employees: Incorrectly labeling employees as independent contractors can lead to underpayment of taxes and legal issues.

- Incorrect Tax Calculations: Failing to use the latest tax tables or miscalculating deductions can result in over or under-withholding.

- Missing Deadlines: Late tax filings or payments can incur fines and interest charges.

- Inadequate Record-Keeping: Poor documentation can make it difficult to verify compliance during audits.

- Neglecting State and Local Taxes: Overlooking regional tax obligations can lead to unexpected liabilities.

Best Practices for Payroll Tax Compliance

Implementing best practices ensures smooth payroll operations:

- Stay Updated: Regularly review IRS guidelines and tax rate changes.

- Use Reliable Payroll Software: Automated systems can reduce errors and streamline tax calculations.

- Conduct Regular Audits: Periodic reviews help identify and correct discrepancies promptly.

- Train Your Team: Ensure staff handling payroll are knowledgeable about tax requirements.

- Consult Professionals: Engage with tax experts to navigate complex situations and maintain compliance.

Year-End Withholding Adjustments: What to Watch For

As the fiscal year concludes, it’s crucial to:

- Review Employee Information: Ensure all personal and tax details are current.

- Reconcile Payroll Records: Verify that all wages and deductions have been accurately recorded.

- Prepare for W-2 Distribution: Timely and accurate W-2 forms are essential for employee tax filings.

- Plan for Bonuses: Understand the tax implications of year-end bonuses and withhold accordingly.

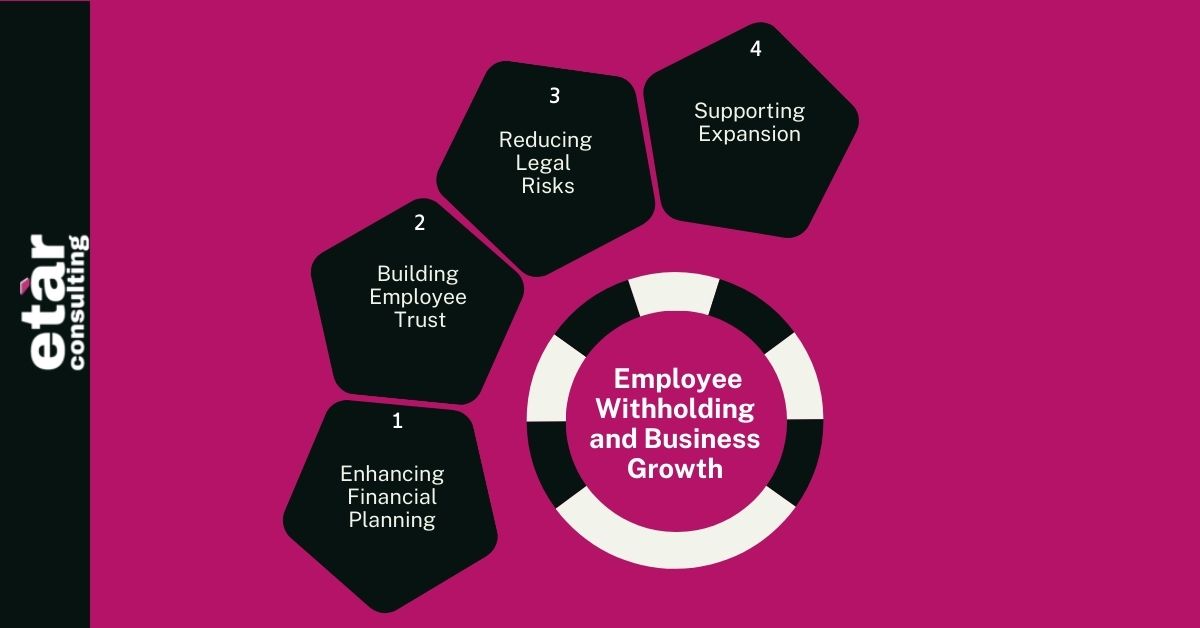

Employee Withholding and Business Growth

Efficient tax withholding practices contribute to business scalability by:

- Enhancing Financial Planning: Accurate forecasting of tax liabilities aids in budgeting and resource allocation.

- Building Employee Trust: Consistent and correct paychecks foster a positive work environment.

- Reducing Legal Risks: Compliance minimizes the chance of audits and associated penalties.

- Supporting Expansion: Streamlined payroll processes are essential when onboarding new employees during growth phases.

The Role of Etar Consulting in Tax Guidance

Navigating tax obligations can be complex. Etar Consulting offers expert assistance in managing employee withholding tax. Their services include:

- Customized Tax Strategies: Tailored solutions for your business needs.

- Compliance Support: Ensuring adherence to all tax regulations.

- Ongoing Consultation: Providing insights to adapt to changing laws.

Partnering with Etar Consulting empowers your business to handle tax responsibilities confidently.

Tax Planning Made Easy: Expert Tips for Every Tax Category

| Tax | Tips |

| Corporate income tax Tips | – Keep detailed records of all business income and expenses.- Take advantage of available tax credits and deductions.- File estimated taxes quarterly to avoid penalties.- Work with a tax advisor for long-term planning. |

| Sales tax Tips | – Register for sales tax in every state where you have nexus.- Keep valid exemption certificates for non-taxable sales.- Automate sales tax calculations with software.- File returns on time to avoid fines.- Stay updated on changing tax laws in different states. |

| Individual income tax Tips | – Choose the right filing status for maximum savings.- Contribute to retirement accounts to reduce taxable income.- Keep receipts for itemized deductions.- Claim all eligible tax credits.- File electronically for faster refunds. |

| Employee withholding tax Tips | – Ensure employees complete and update Form W-4 correctly.- Use payroll software to calculate accurate withholdings.- Remit taxes to the IRS and state agencies on time.- Stay compliant with federal and state wage laws.- Review withholding annually, especially after major life events. |

| Tax deduction strategies Tips | – Track business and personal deductions separately.- Maximize deductions with charitable giving and education credits.- Use a home office deduction if eligible.- Deduct health care premiums if self-employed.- Consider bunching deductions into one tax year for greater savings. |

Final Thoughts

Managing employee withholding tax is essential for legal compliance and business integrity. By understanding the basics, avoiding common mistakes, and seeking professional guidance, you can ensure accurate tax handling. Embrace these practices to foster a trustworthy and successful business environment.

FAQs

1. What is employee withholding tax?

It’s the tax amount deducted from an employee’s paycheck for income and payroll taxes.

2. How often should W-4 forms be reviewed?

At least once a year or after major life changes like marriage or having a child.

3. What if I make a withholding mistake?

Correct it immediately and report the changes to the tax authorities to avoid penalties.

4. Can software help with withholding taxes?

Yes, payroll tools or firms like Etar Consulting automate the process accurately.

5. Is withholding the same for all employees?

No, it varies based on income, filing status, and personal allowances.